GAAP, IFRS, or Cash? Picking Your Financial Compass Wisely

April 12, 2025

Your Location Dictates Your Financial Rules

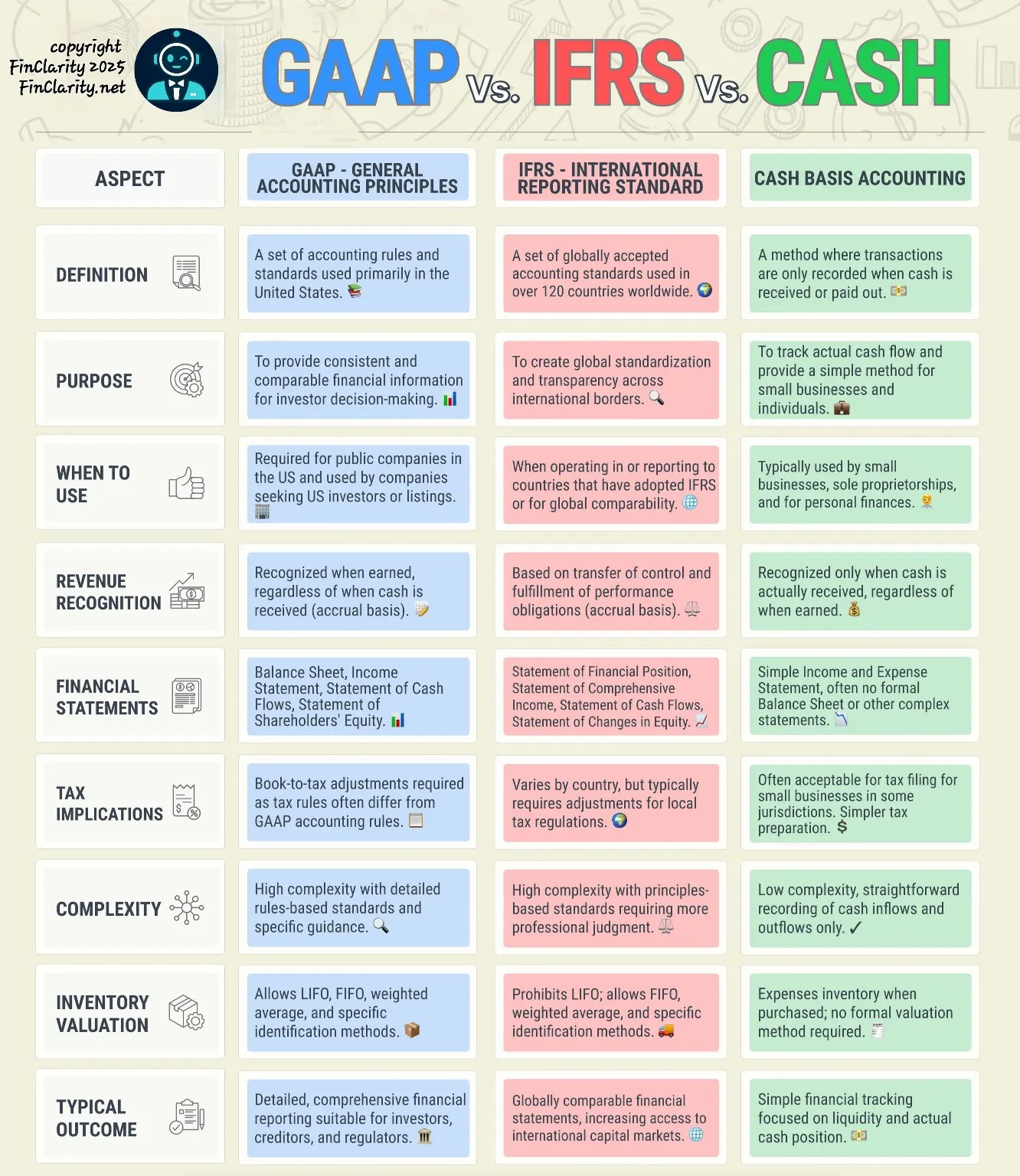

The world speaks two main accounting languages—GAAP in the U.S., and IFRS globally. Both offer detailed guidance for transparent financial reporting, but how much does this guidance matter if you're a small business or a rapidly scaling startup?

CFO Insight: Know your audience. If you’re reporting to investors or regulators, GAAP or IFRS aren't optional—they're essential. But what about when your stakeholders are primarily internal, or your bank balance is the bottom line?

Simplicity and Control: The Case for Cash Basis

Cash basis accounting might seem simplistic—and technically, it's not "accounting" in the strictest sense—but it has a hidden power: clarity. Your bank statement never lies, offering you immediate, practical insight into your true financial health. For startups, sole proprietors, or SMBs, cash accounting reduces complexity and enhances agility.

CFO Insight: Complexity isn’t always your friend. If regulatory oversight isn’t an issue, a cash approach can offer superior clarity and flexibility. It frees you from accounting adjustments and accrual confusion, allowing you to focus your energies on growing your business rather than just managing books.

Accrual Accounting: The Necessity of GAAP and IFRS

GAAP and IFRS are built around accrual accounting, recording revenue when earned—not when cash hits your account. This approach provides crucial visibility for investors, creditors, and management, highlighting your business’s true financial position and future obligations.

CFO Insight: If your plans include scaling through investment, IPO, or heavy borrowing, mastering accrual accounting isn't just good practice—it's mandatory. Both GAAP and IFRS will arm you with the financial transparency investors demand.

Flexibility vs. Formality: Which Way Forward?

Your choice between GAAP, IFRS, and cash accounting comes down to one question: what's your strategic goal?

- Growth and Regulation: Opt for GAAP or IFRS.

- Agility and Simplicity: Stick to cash basis.

CFO Insight: Align your accounting approach to your growth stage and stakeholders. Using cash today doesn't bar you from transitioning later, but switching standards requires thoughtful preparation.

Final Thought: Your Financial Method Defines Your Business Trajectory

The decision between GAAP, IFRS, and cash basis accounting isn't trivial—it's strategic. It defines how clearly you see your business, how flexible your operations can remain, and how prepared you are for growth or regulatory scrutiny.

CFOs: Evaluate your accounting needs with the same rigor you apply to your products, markets, and competitors. Which financial compass aligns with your business vision?